Europe’s Terminal to Import Liquefied Natural Gas (LNG) STILL Heavily Underused

Just like in 2018, Food & Water Europe again analyzed the utilization rate of EU LNG terminals based on data from Gas Infrastructure Europe. LNG terminals are facilities that enable the import of liquefied natural gas(LNG), gas that is cooled down so its volume is reduced by a ratio of 1:600 and can be shipped across the ocean via LNG tankers.

By Andy Gheorghiu and Frida Kieninger

What is a utilization rate, and why does it matter?

What is a utilization rate, and why does it matter?

Just like in 2018, Food & Water Europe again analyzed the utilization rate of EU LNG terminals based on data from Gas Infrastructure Europe. LNG terminals are facilities that enable the import of liquefied natural gas(LNG), gas that is cooled down so its volume is reduced by a ratio of 1:600 and can be shipped across the ocean via LNG tankers.

The utilization rate is the percentage at which existing LNG infrastructure is actually being used. In other words, if a terminal has an annual import capacity of 10 billion cubic meters (bcm) of gas, but only imports 5 bcm, its utilization rate is at 50 percent.

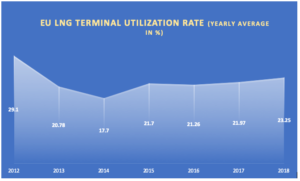

The time period we looked at was from 2012 until March 2019 and it is striking at how little these costly facilities have been used during the past seven years. It is important to take into account the low utilization rates since they show clearly that there is no need to invest in more LNG facilities. Nevertheless, there is a push for more LNG terminals in Europe and several of these costly facilities are being planned, many of which are clearly linked to fracked gas from the US. If we don’t want to lock Europe into even more fossil fuels and move to a renewable energy system, we cannot waste money on LNG infrastructure but have to channel as much financial and political support as possible to renewables.

EU Utilization Rates: The Numbers

EU gas demand picked up again after 2014 and is on the rise today. LNG imports however, only saw a short rise between 2014 and 2015. Since this rise, LNG volumes entering the EU have been stagnating around about 22 percent.

The different European LNG terminals show highly varying utilization rates, with four terminals operating at less than 10 percent of their capacities and only two terminals operating at over 50 percent.

The terminal least used in Europe during the past seven years is Gate Terminal in Rotterdam, the Netherland’s only LNG terminal. During recent years it only operated at around 7 percent of its capacity. There are three other LNG terminals that are operated at similarly low levels, all at around 8 percent: The French Dunkerque LNG terminal, the Spanish Cartagena LNG terminal and the UK’s Isle of Grain LNG terminal.

On the other side, those terminals showing the highest utilization percentages are in France and Italy. The EU-LNG terminal most in use is the Italian Adriatic LNG Terminal used at around 73 percent, followed by French Fos Tonkin terminal operating at almost 58 percent.

European national and EU level decision makers have to take into account the high costs of LNG infrastructure and the strikingly low utilization rates when implementing a European energy strategy. Truly clean and affordable energy for all Europeans should be the aim, and not further investment in costly, unneeded fossil fuel infrastructure to keep the oil and gas industry alive.

See the table (.pdf) with a detailed overview of utilization rates for each European LNG terminal.

(Contact [email protected] for the underlying data.)