Blog: Europe’s Terminals to Import Liquefied Natural Gas (LNG) Heavily Underused

This month, Food & Water Europe analyzed the utilization rate of EU LNG terminals based on data from Gas Infrastructure Europe. LNG terminals are facilities that enable the import of liquefied natural gas (LNG), gas that is cooled down so its volume is reduced by a ratio of 1:600 and can be shipped across the ocean via LNG tank

See the 24 July 2019 updated blog

By Andy Gheorghiu and Frida Kieninger

This month, Food & Water Europe analyzed the utilization rate of EU LNG terminals based on data from Gas Infrastructure Europe. LNG terminals are facilities that enable the import of liquefied natural gas (LNG), gas that is cooled down so its volume is reduced by a ratio of 1:600 and can be shipped across the ocean via LNG tankers.

What is a utilization rate, and why does it matter?

The utilization rate is the percentage at which existing LNG infrastructure is actually being used. In other words, if a terminal has an annual import capacity of 10 billion cubic meters (bcm) of gas, but only imports 5 bcm, its utilization rate is at 50 percent.

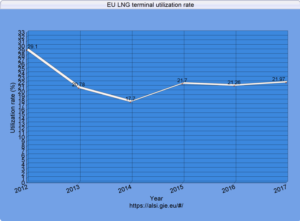

The time period we looked at was from 2012 until early 2018 and it is striking at how little these costly facilities have been used during the past six years. It is important to take into account the low utilization rates since they show clearly that there is no need to invest in more LNG facilities. Nevertheless, there is a push for more LNG terminals in Europe and several of these costly facilities are being planned. If we don’t want to lock Europe into even more fossil fuels and move to a renewable energy system, we cannot waste money on LNG infrastructure but have to channel as much financial and political support as possible to renewables.

EU Utilization Rates: The Numbers

EU gas demand picked up again after 2014 and is on the rise today. LNG imports however, only saw a short rise between 2014 and 2015. Since this rise, LNG volumes entering the EU have been stagnating around about 21.5 percent.

The different European LNG terminals show highly varying utilization rates, with six terminals operating at less than 10 percent of their capacities and only two terminals operating at over 50 percent.

The terminal least used in Europe is Gate Terminal in Rotterdam, the Netherland’s only LNG terminal. During recent years it only operated at around 4 percent of its capacity. There are two Italian LNG terminals, the Offshore LNG Toscana (around 6 percent) and the Panigaglia LNG Terminal (around 8 percent) and a French terminal, Dunkerque LNG (around 5 percent) that operated at similarly low levels, as well as the UK terminal Isle of Grain LNG working at only 7 percent.

On the other side, those terminals showing the highest utilization percentages are also in France and Italy. The EU-LNG terminal most in use is the Italian Adriatic LNG Terminal used at around 71 percent, followed by French Fos Tonkin terminal operating at almost 60 percent.

European national and EU level decision makers have to take into account the high costs of LNG infrastructure and the strikingly low utilization rates when implementing a European energy strategy. Truly clean and affordable energy for all Europeans should be the aim, and not further investment in costly, unneeded fossil fuel infrastructure to keep the oil and gas industry alive.

See table table (.pdf) with a detailed overview of utilization rates for each European LNG terminal.

Get the data.