Fracked Gas Imports Produced Europe’s Fossil Fuel Crisis

LNG terminal utilization rates reveal underlying problems

For years, the fossil fuel industry assured Europe that importing LNG and therefore more and more fracked gas would help avoid costly energy shortages. But the ongoing supply crisis – which has led to skyrocketing bills – shows how deepening our reliance on fossil fuels has been an expensive failure.

Imported liquified natural gas (LNG) is also a disaster for our environment and the climate. It is fossil gas that is chilled to -162 degrees and then transported via vessels to far-away destinations. The process is highly energy intensive: the energy needed just to operate all existing and planned US liquefaction terminals would create CO2 emissions equaling those of 24 coal power plants. In fact, the entire supply chain of LNG is harming communities, impacted by air and water pollution from fracking, pipelines and the chilling of methane to create LNG.

Despite these issues, a significant portion of the EU’s energy needs are filled by this particularly dirty fuel, made possible by a global network of fossil fuel infrastructure that allows world leaders and oil and gas companies to manipulate supplies. These are the exact same issues the politicians are investigating in a hearing on corporate price gouging in the US. Never ones to let a crisis go to waste, fossil fuel companies and some political leaders are clamoring to build more import and export LNG projects, turning a blind eye to the inherent dangers posed by the industry. While this might be good for fossil fuel company profits, the rest of us

will suffer from the expansion of this industry.

Click here to enlarge picture.

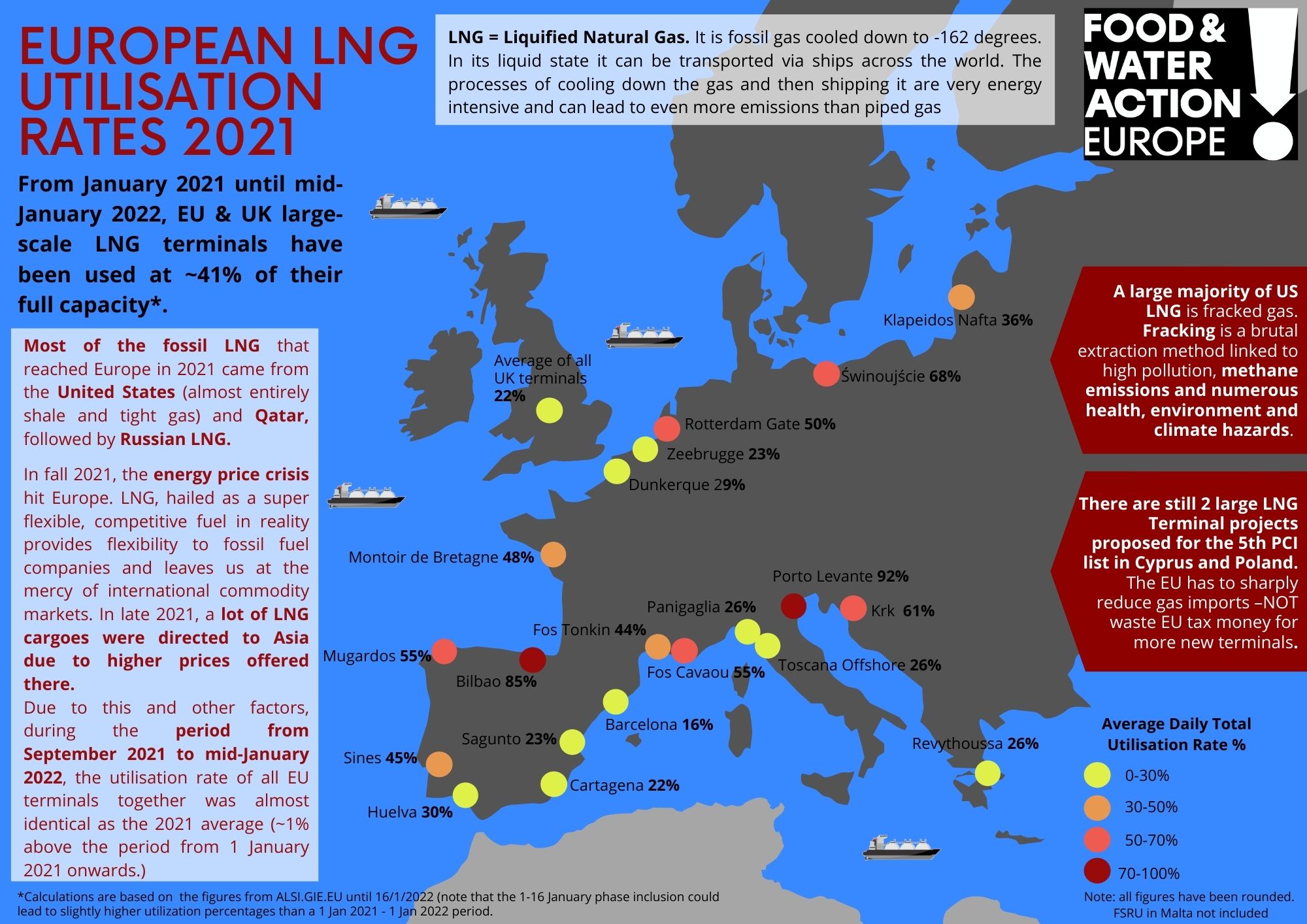

Food & Water Action Europe looked at data from Gas LNG Europe for all EU large scale LNG terminals to assess to what extent these facilities have been using the available capacity between January 2021 and mid-January 2022. We also compared this with the utilization rates for September 2021 until mid-January, when the energy price crisis really hit. What we found is significant oversupply in import capacity with a few facilities importing near their maximum capacity.

European LNG terminals by the Numbers

Although LNG terminals have been used more over the past decade, the utilization rate of all EU terminals from January 2021 through mid-January 2022 is around 40%, trending downward from 46% in 2019 and 2020. The latest EU gas market analysis confirms the trend is continuing, with LNG imports decreasing by 9% in the third quarter of 2021, compared to the same period in 2020.

LNG has been hailed for years as a super flexible, competitive fuel, but in reality, it provides flexibility to fossil fuel companies and leaves the rest of us at the mercy of international commodity markets. Last October, higher prices in Asia – over 500% in some cases — made it more profitable to divert shipments of LNG to those markets.

Most of the LNG Europe imports comes from the U.S. – in the first three quarters in 2021, the U.S. was the #1 supplier of the liquefied fuel. Europeans who oppose fracking have expressed intense opposition to these developments, since most of the U.S. gas is produced by using the extremely harmful extraction method of hydraulic fracturing.

Busy LNG terminals Vs Idling LNG terminals

While most of us lose from LNG developments, the obvious ‘winner’ is Porto Levante LNG terminal in the Northeast of Italy, which operated at a 92% capacity last year and 87% since September. Conversely, the two other Italian LNG terminals showed below-average utilization rates over the same periods.

Bilbao LNG in Spain came in second, with a utilization rate of almost 85% in 2021 and of over 70% since September. Four out of the five other Spanish terminals were used at only 15-30% in 2021, increasing to 19-39% in the period from September onwards.

Spain and France are Europe’s biggest LNG importers, with 6 and 4 large scale LNG terminals respectively. The main LNG supplier for Spain in the third quarter of 2021 has been the U.S. followed by Nigeria and Qatar. For France, the top supplier was Nigeria, followed by Russia.

At the bottom of the LNG utilization list is Barcelona LNG in Spain, used at only about 15% in 2021 and 19% since September. Italy’s Panigaglia LNG terminal was used at about a quarter of its capacities in 2021 and even less, at only at 8%, since September. Building new LNG capacity is hardly necessary given the significant LNG capacity underutilization and the fact we need to be ramping down not ramping up fossil fuel infrastructure.

LNG Hungry Countries

We also found that LNG utilizations rates vary by country as well, with Eastern European Countries having higher top level utilization rates. In terms of the country-level, top utilization rates can be found in Poland. Almost 68% of the capacity of the state’s Swinoujscie terminal was used in 2021, and over 62% since September, mostly originating from Qatar. Rather than working to transition off this dirty fuel with so many problems, Poland is expanding LNG import capacity.

Croatia has a similar story, with the second biggest appetite for LNG compared to import capacity. Croatia’s highly contested Krk LNG terminal, which started operating in 2021, raises the country’s LNG utilization rate to above 60% for 2021 and over 70% since September, with gas coming mostly from Qatar and from the U.S.

Over the past few years, Gate Terminal, the only LNG terminal in the Netherlands, has ramped up its utilization rate. It stood at over 50% during the past year, and at over 60% from September onwards.

The country with the lowest utilization rate in the EU was Belgium, with its Zeebrugge LNG terminal working at only 23% of its capacity last year and 20% since September.

Between January 2021 and mid-January 2022, only the UK’s terminals were used less than that, at barely 22%.

LNG: Fossil Fuel False Hopes

The European experience shows dependence on LNG enables and exacerbates the current energy supply shortages. It is being built to accommodate gas from the fracking fields in the United States, which are causing considerable environmental and public health concerns, not to mention accelerate the climate crisis. The good news is, we have alternatives to this fossil fuel industry scheme to continue Europe’s dependance on gas.

We can tackle both the climate crisis and prevent energy poverty by rejecting new LNG infrastructure and moving to truly clean renewable energy and heating solutions, including electrification, and energy efficiency. In the coming weeks, EU decision-makers consider the plans for prioritizing energy infrastructure in the next round of the Projects of Common interest. They can make critical decisions necessary to make Europe transition off dirty polluting LNG.

You can find detailed numbers on each EU large-scale LNG terminal here.