2023 EU LNG Terminal Utilization Rates Were Below 60%

LNG moved to the spotlight in January 2024, with an important announcement by US President Joe Biden to halt all new permitting for US LNG export facilities. This ‘pause’ will give the government time to work on criteria for an assessment of this infrastructure concerning public interest, human rights and climate implications of these fossil fuel assets.

While this is a great step in the right direction, the halt is only temporary, and a host of other LNG expansion projects in the US which already have obtained permits can move ahead.

As usual, the fossil fuel industry was quick to cry ‘foul’ over the Biden administration’s plans. They claimed the announcement went too far and will create energy security concerns. There are several arguments to refute this claim.

The most important point that big polluters want to sweep under the carpet is that fossil gas is on its way out. EU gas demand dropped by 12% compared to the 2019-21 average in 2022, and by 19% in 2023. Crucial climate and energy policies in Europe suggest a reduction of gas demand by up to 52% by 2030.

The gas demand drop needs to be made permanent and deepened further for Europe to have a chance to abide by its own climate targets and to respond to the deepening climate crisis.

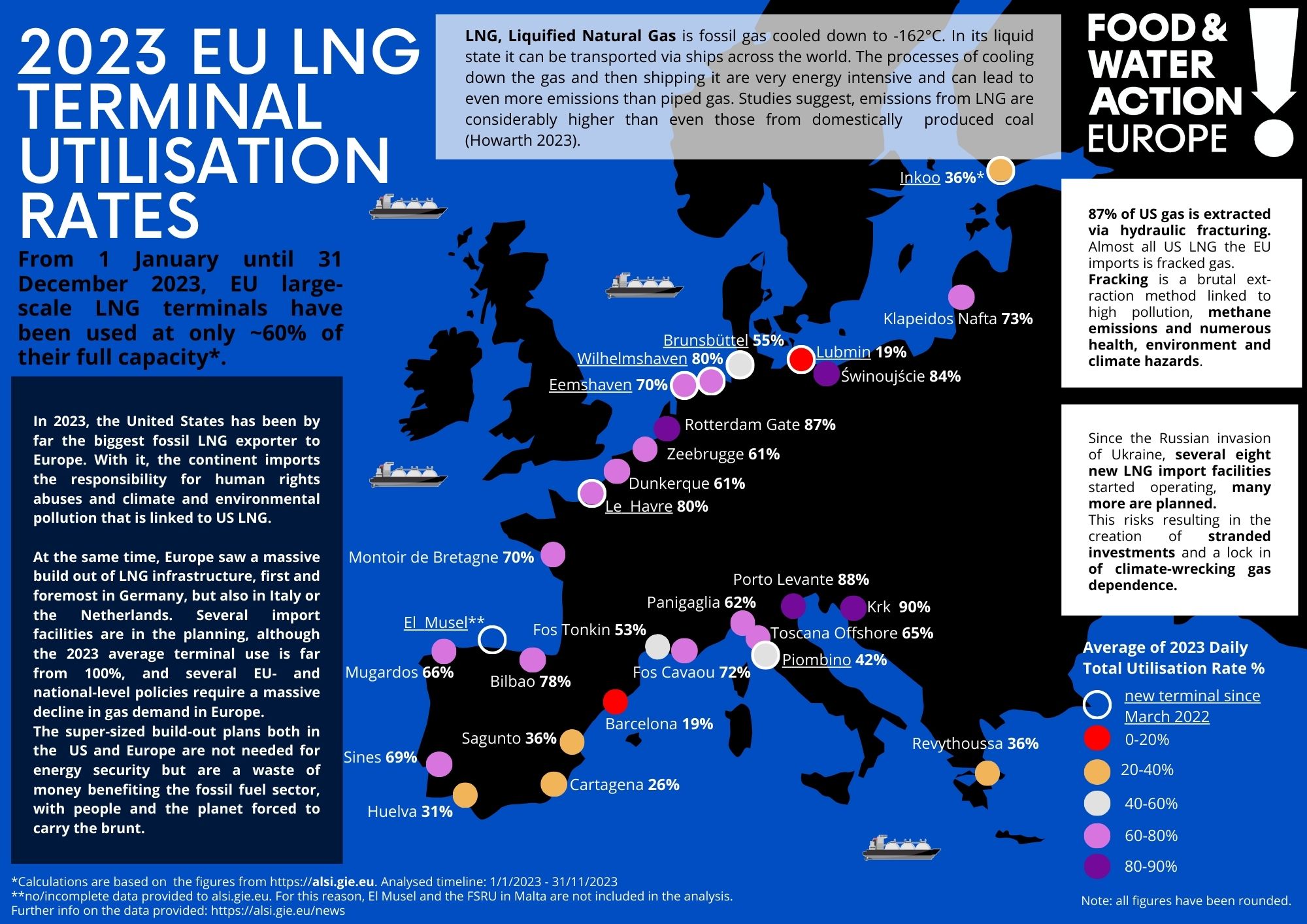

Despite the drop in gas demand and the planned expansion of US export facilities, it is clear the current import infrastructure in Europe is largely underutilized. Our analysis of data from the Aggregated LNG System Inventory (alsi.gie) suggests that in 2023, EU LNG terminals were used on average under 60% of their full capacity.

Only four LNG terminals across the EU had average utilization over 80% (by terminals in Porto Levante – Italy, Swinoujscie – Poland, Rotterdam – The Netherlands and Krk – Croatia) in 2023, while ten terminals were used well under 60%, sometimes at only 19% (terminals in Barcelona – Spain/Catalonia and Lubmin – Germany).

The lowest country-wide LNG utilization rate can be observed in Greece and Finland (both 36% utilization rate) followed by Spain (42%). It needs to be noted that one terminal in Spain – El Musel LNG which started operations in 2023 – didn’t report any data despite having imported some shipments already. It was not included in the country’s average calculation.

In addition to the El Musel and Inkoo terminals , there are another six large scale LNG import terminals which came online since the Russian invasion of Ukraine. Most of those are located in Germany (Brunsbüttel, Wilhelmshaven, Lubmin) with the country planning to build even more terminals, fueling significant protests. On top of that, average utilization in Germany stood at only 50%.

Additionally, in early February 2024, EU gas storage was still at a very high level and well above 60% on average. Energy experts suggest that even with a full cut of Russian gas and a cold winter, gas storage would still be filled at over 20% at the end of March when winter ends.

LNG infrastructure expansion on both sides of the Atlantic is not only a dangerous climate bomb – it is economically nonsensical, risking a situation in which consumers are burdened with costs for stranded assets of an unneeded oversized fossil gas grid.